Cost Transfers

Cost Transfers on Sponsored Projects

FASOP: AS-07

A cost transfer is an after-the-fact reallocation of the cost associated with a transaction from one account to another. A cost transfer is any transfer of expenditures to a sponsored project via a manual journal or a payroll accounting adjustment. Federal agencies and auditors place a great deal of emphasis on reviewing transfers of expenditures.

All accounts should be reviewed timely to be certain all expenditures have been properly charged. If a cost transfer is required, please follow these guiding principles:

- The cost must be a proper and allowable charge to the project to which it is transferred.

- To be allowable, cost transfers must be timely, fully documented, conform to university and sponsor allowability standards.

- The cost transfer must be timely – within 90 days from the end of the month in which the original entry was recorded. Requests for cost transfers to be processed beyond the 90 days must include an explanation of the extenuating circumstances that prevented the cost transfer from being made earlier and requires the additional approval of the department head and the Director of SPA (or their designee).

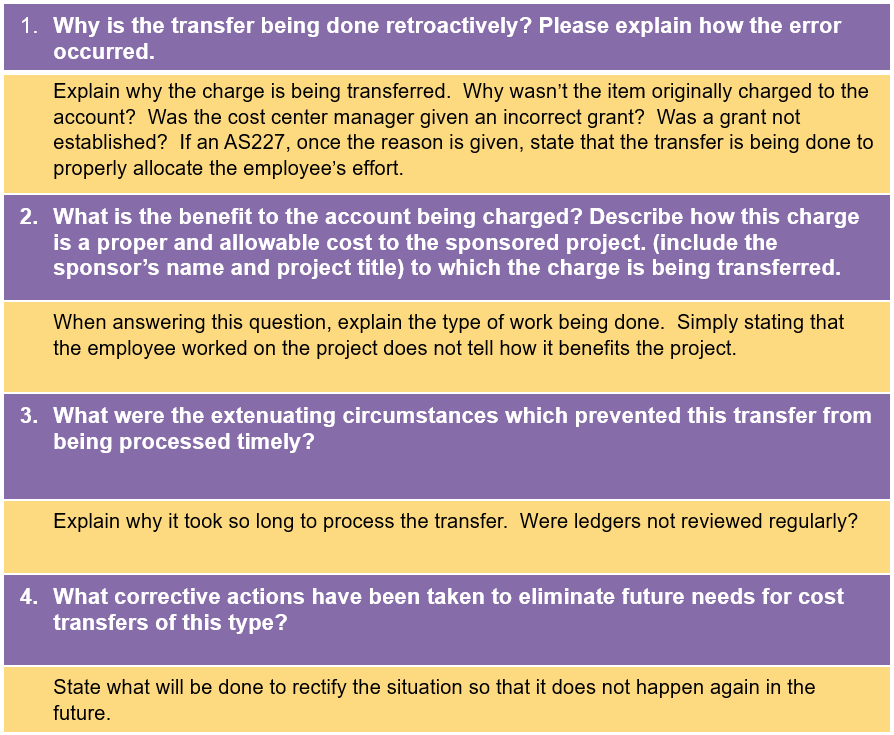

- The cost transfer request must be supported by documentation that contains a full

explanation and justification for the cost transfer. An explanation which merely states

that the transfer was made “to correct error,” “to transfer to correct project,” or

“to clear overdraft” is not acceptable. A copy of the pdf version of the expenditure

report from Workday with the expenditure identified (e.g., highlighted, underlined)

must also be attached.

- For a non-payroll cost transfer, Form AS226 must be completed to transfer expenditures to a sponsored agreement. Attach to the Accounting Journal in Workday.

- For a payroll cost transfer, Form AS227 must be completed to transfer payroll to a sponsored agreement. Attach to the Payroll Accounting Adjustment in Workday.

Some helpful hints when completing the AS226 or AS227:

Cost transfers to expired fixed price agreements, Foundation, gifts, or state appropriations (unrestricted funds) only require submission of a manual journal with a copy of the ledger sheet with the expenditure appropriately annotated. An AS226 or AS227 is not required.

Cost transfers are not allowable following the submission of the final expenditure report to the sponsor, unless they involve reconciling items of which the SPA contact was aware.

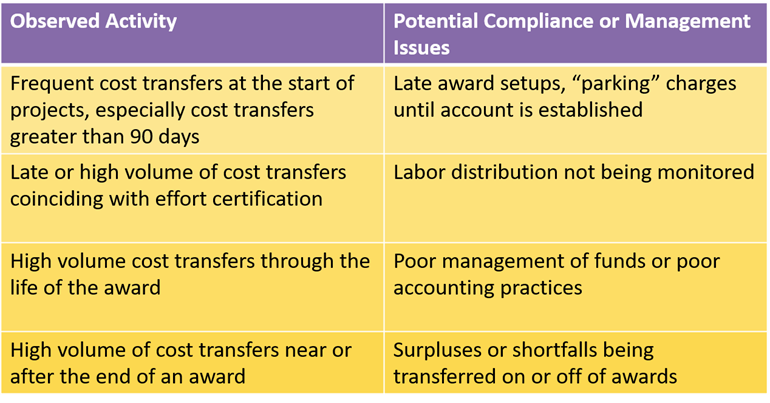

Constant or frequent transfers raise serious questions about their propriety as well as the overall reliability of the accounting system and internal controls.:

Job aids are located on LSU Workday website:

- Financial Accounting: Create Journal Entry: Correction Journal

- Payroll: Create Payroll Accounting Adjustment